Lease Managements

Find out about Land Betterment Charge and Lease Management

On this page

Land Betterment Charge

With effect from 1 August 2022, a new Land Betterment Charge (LBC) has replaced Differential Premium, Development Charge (DC) and Temporary Development Levy (TDL), which were previously administered by the Singapore Land Authority (SLA) and Urban Redevelopment Authority (URA) respectively. The LBC is a tax on the increase in value of land arising from a chargeable consent (e.g. planning permission) given in relation to a development of any land.

Under the LBC, landowners seeking to develop their sites need not make a separate application to SLA for the payment of LBC once a planning application or plan lodgment for an authorised development has been submitted to URA. If the proposed development results in an increase in land value, SLA will follow up directly with the taxable person by issuing a Liability Order (LO) stating the LBC payable. Payment must be made to SLA within 1 month from the date of the LO. This will apply to all planning permissions, plan lodgement and variation of restrictive covenants granted on or after 1 August 2022.

The principles for computing LBC follow the previous DP and DC systems, known as the Table of Rates method. LBC will be computed based on the difference between the value of the post-chargeable valuation and pre-chargeable valuation. Post-chargeable valuation is the value derived from the variation of the relevant restrictive covenant, or the proposed use(s) and intensity in URA’s planning permission or plan lodgement. Pre-chargeable valuation is the value derived from the restrictive covenants in the State title or the last authorised/approved development. The historical Master Plans 1958/1980/2003 will continue to be taken into account in the determination of pre-chargeable valuation, where applicable.

For more information, please refer to this circular dated 5 July 2022 and the attached documents.

LBC Circulars

S/No. | Date | LBC Circulars |

|---|---|---|

1 | 2 July 2022 | |

2 | 29 August 2025 | ENHANCED CLARITY ON LAND BETTERMENT CHARGE FOR SOLAR DEVELOPMENTS |

Table of Rates 2022

Month/Year | Sector Maps | Use Groups | Table of Rates |

March 2022 | |||

September 2022 | Land Betterment Charge Table of Rates as of 23 September 2022 |

Table of Rates 2023

Month/Year | Sector Maps | Use Groups | Table of Rates |

March 2023 | |||

September 2023 | Land Betterment Charge Table of Rates as of 1 September 2023 |

Table of Rates 2024

Month/Year | Sector Maps | Use Groups | Table of Rates |

March 2024 | |||

September 2024 | Land Betterment Charge Table of Rates as of 1 September 2024 |

Table of Rates 2025

Month/Year | Sector Maps | Use Groups | Table of Rates |

March 2025 | |||

September 2025 | Land Betterment Charge Table of Rates as of 1 September 2025 |

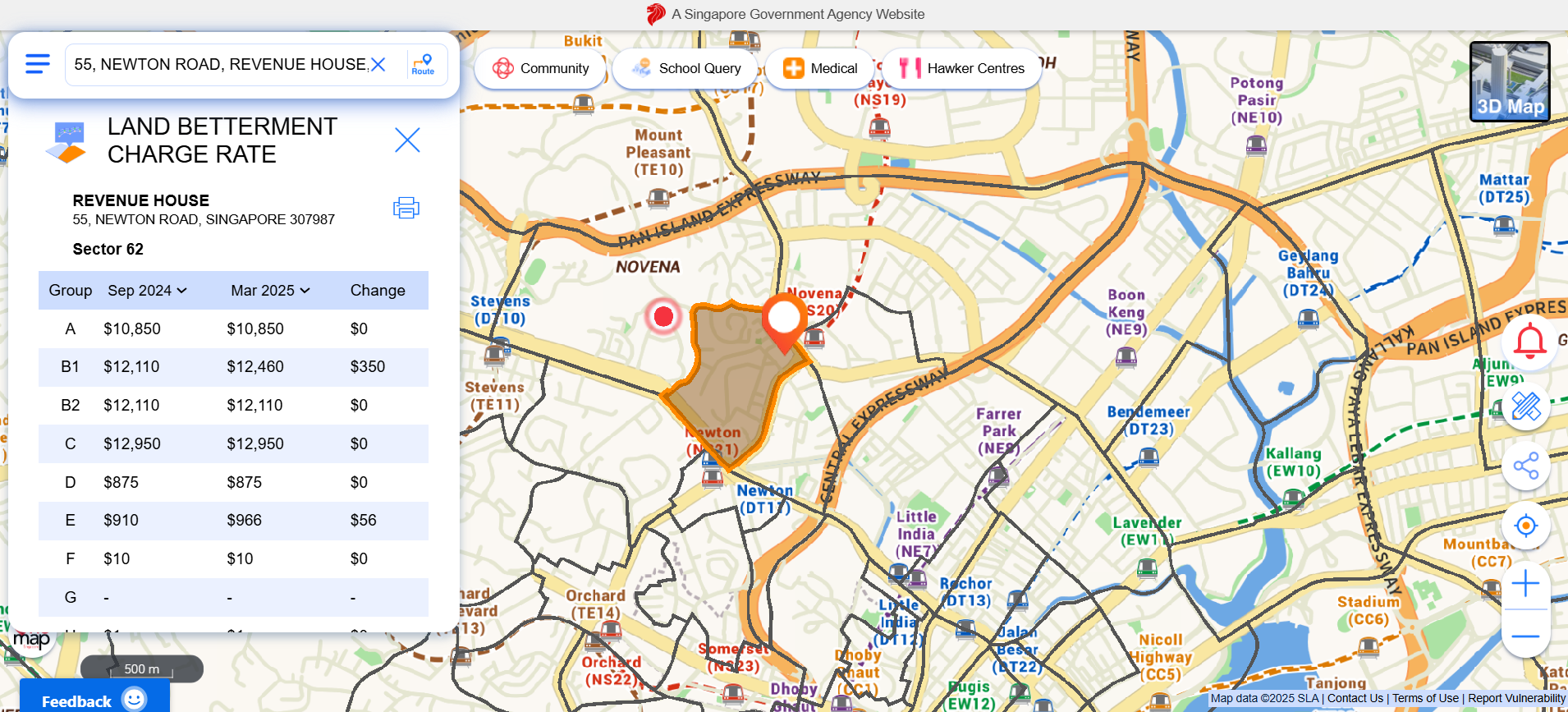

From 1 March 2024, the LBC Rates for all Use Groups from September 2022 to September 2025 will be available on OneMap. Members of the public can check the LBC rates for the respective geographical sectors on OneMap.

LBC rates on OneMap

For use in determination of pre-chargeable value for safeguarded historical base line (where applicable)

Processing fee

A fee of $1,100 will be collected for updating the land’s baseline value, and this will be payable together with the LBC when the LO is issued.

Option for spot valuation

In cases where there is no suitable or comparable use group for assessment, the Valuation method will apply. Taxable persons may also elect to use the Valuation method, which is irreversible, in lieu of the Table of Rates method by using a prescribed form.

Application for the Election of Valuation Method

Receiving a liability order

Every liability order will include details such as (i) the amount of LBC payable; (ii) the name of the taxable person(s) (and apportionment, if any; and (iii) the methods by which payment for LBC can be made. Upon receipt of a liability order, the LBC payable by a taxable person is due to SLA at the end of one month. Once LBC has been paid in full, the liability order will cease to have effect.

Forms

Assumption of Liability Notice

A person who wishes to assume liability to pay any LBC for a chargeable consent may inform SLA inform using the following form.

Application for Assumption of Liability

Deferment Determination

A charitable institution using the land for charitable purposes may apply to SLA for a deferment to pay LBC using this form. .

Application for Deferment Determination

Transfer of Deferred Liability

A taxable person whose liability to pay any LBC is deferred may apply to transfer his deferred liability to another person using this form.

Application for Notice of Transfer of Deferred Liability

Evidentiary Certificate

An owner or prospective owner of a land may use this form to apply for a certificate for the purpose of determining his liability for LBC.

Application for Evidentiary Certificate

Renewal of lease

All State leases have specific tenures. Property owners can apply for the renewal of leases, and each application will be considered on its own merits, bearing in mind the Government’s long-term plans for the land and in consultation with other public agencies. Please refer to the current Lease Renewal Policy.

You may apply for the renewal of a lease using this online application form. Please refer to this link for a list of necessary documents required for submission with the online application form.

Processing Time

Generally, if an application is in order, the estimated processing time for such an application is approximately 20 weeks from the date of SLA’s receipt of all necessary documents required to process the application. Please note that this is an estimate, and the actual processing time may vary and/or be extended for applications of a complex nature, or for applications where revised or additional information is required or significant changes are made to the application after submission.